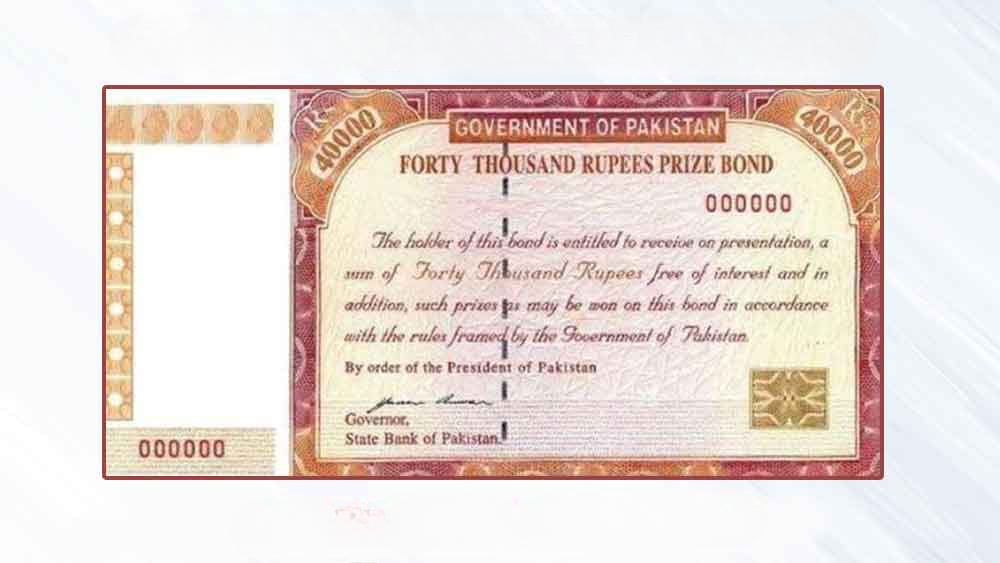

Prize Bond Rs. 40000/-

What are Prize Bonds?

Prize Bonds are a popular investment choice in Pakistan, blending the thrill of a lottery with the safety of a government-backed scheme. Introduced in 1960 by the Government of Pakistan, they were designed to encourage savings while offering cash prizes through lucky draws. Unlike traditional investments that pay interest, Prize Bonds are lottery bonds—your money stays secure, and you get a shot at winning big.

The Government of Pakistan, through the National Savings Centre and State Bank of Pakistan, issues these bonds in various denominations: Rs. 100, Rs. 200, Rs. 750, Rs. 1500, Rs. 7500, Rs. 15000, Rs. 25000, and the high-stakes Rs. 40000. Among these, Prize Bonds Rs. 40000 stand out as a premium option, appealing to those ready to invest more for a chance at larger rewards.

Understanding Prize Bonds Rs. 40000

The Rs. 40000 Prize Bond is one of the highest denominations available, making it a significant investment choice. It’s not just one bond, though—there are two versions: the regular Rs. 40000 Prize Bond and the Premium Rs. 40000 Prize Bond. Both require a Rs. 40000 investment per bond, but they cater to slightly different goals.

The regular version is straightforward: you buy it, hold it, and hope to win in the quarterly draws. The Premium Rs. 40000 Prize Bond, however, sweetens the deal with bigger potential prizes and an added bonus of bi-annual profit payments. It’s a step up for those who want more than just a lottery ticket—they want a reward even if luck doesn’t strike. Either way, Prize Bonds Rs. 40000 are for those willing to invest a larger sum for a shot at transformative winnings.

Benefits of Investing in Prize Bonds Rs. 40000

Why choose Prize Bonds Rs. 40000? Here’s what makes them appealing:

- Safety: Backed by the Government of Pakistan, your investment is as secure as it gets—no risk of losing your money to shady schemes.

- No Loss of Principal: Even if you don’t win, your Rs. 40000 stays intact. You can cash it out anytime or keep it for future draws.

- Potential for High Returns: With prizes up to Rs. 80 million for Premium bonds and Rs. 75 million for regular ones, the rewards can be life-altering.

- Liquidity: Need your money back? Encash your bond at any bank or National Savings Centre with ease.

- Tax Benefits: Winnings come with tax implications—15% for filers and 35% for non-filers—but the principal remains untouched, offering a clean slate.

Take Ali, a small business owner from Lahore. He invested in a few Rs. 40000 bonds last year. While he hasn’t hit the jackpot yet, he loves the peace of mind knowing his money is safe—and the dream of winning keeps him excited for every draw.

How Prize Bonds Rs. 40000 Work

Getting started with Prize Bonds Rs. 40000 is simple. You can buy them from the State Bank of Pakistan, National Savings Centres, or any commercial bank. For the regular bond, it’s a quick cash transaction—no paperwork needed. The Premium version, though, requires a bit more: a filled application form, your CNIC, and an active bank account in your name for profit payments.

Once purchased, your bond enters the prize bond Rs. 40000 draw, held quarterly by the National Savings committee. These draws are transparent, often conducted with a hand-operated machine and overseen by officials to ensure fairness. A child typically operates the device, pulling out winning numbers in front of an audience—adding a touch of charm to the process.

Prize Bond Rs. 40000 Draw Schedule

The prize bond draw Rs. 40000 happens four times a year—once every three months. Typically, these draws occur in March, June, September, and December, though exact dates can shift slightly. For 2025, the first draw (Draw No. 32) took place on March 10 in Quetta, with the next one slated for June.

To stay updated, check the official National Savings website (savings.gov.pk) or the State Bank of Pakistan’s schedule. These sources list the exact dates, cities, and draw numbers, ensuring you never miss a prize bond Rs. 40000 draw.

Prizes and Winnings

The prize structure for Prize Bonds Rs. 40000 is where the excitement lies. Here’s the breakdown:

- Regular Rs. 40000 Prize Bond:

- First Prize: Rs. 75,000,000 (1 winner)

- Second Prize: Rs. 25,000,000 (3 winners)

- Third Prize: Rs. 500,000 (1,696 winners)

- Premium Rs. 40000 Prize Bond:

- First Prize: Rs. 80,000,000 (1 winner)

- Second Prize: Rs. 30,000,000 (3 winners)

- Third Prize: Rs. 600,000 (1,696 winners)

To claim your prize, visit a National Savings Centre or State Bank branch with your winning bond and CNIC. Prizes under Rs. 1,250 can be claimed at the National Savings Centre, while larger amounts go through the State Bank. You have six years from the draw date to collect your winnings, so don’t rush—but don’t forget either!

Checking prize bond Rs. 40000 draw results is easy—more on that later.

Premium vs. Regular Prize Bonds Rs. 40000

Choosing between Premium and regular Prize Bonds Rs. 40000? Here’s how they stack up:

- Prize Amounts: Premium offers Rs. 80 million as the top prize versus Rs. 75 million for regular bonds. Second and third prizes are also higher with Premium.

- Profit Payments: Premium bonds pay a floating profit every six months (rates vary, often around 5-6% annually), while regular bonds offer no profit—just the prize chance.

- Eligibility: Anyone can buy regular bonds with cash. Premium bonds require a bank account and registration, limiting them to individuals or businesses with formal financial setups.

- Conversion: Have regular bonds? You can convert them to Premium by visiting a bank, submitting your bonds, and linking them to your account.

Sana, a Karachi-based teacher, switched to Premium bonds last year. She enjoys the small profit payments—enough to cover a family outing—while still dreaming of that Rs. 80 million win.

Investing in Prize Bonds Rs. 40000: Strategies and Tips

Want to boost your chances? Try these strategies:

- Buy in Series: Purchasing bonds with consecutive numbers (e.g., 123456 to 123460) increases your odds slightly since each bond is a separate entry.

- Pick Thoughtfully: Some swear by choosing numbers with personal meaning—like birthdays—but it’s all luck. No number is “luckier” than another.

- Avoid Rumors: Steer clear of unofficial “winning number” tips online—they’re often scams.

- Invest Responsibly: Don’t pour all your savings into bonds. Treat it as a fun, low-risk addition to your financial plan.

Start small—maybe one or two bonds—and scale up as you get comfortable.

Checking Prize Bond Rs. 40000 Draw Results

Missed the live draw? No worries. Here’s how to check prize bond Rs. 40000 draw results:

- Visit savings.gov.pk or sbp.org.pk.

- Find the “Prize Bond Results” section.

- Select the Rs. 40000 draw date and number (e.g., Draw No. 32, March 10, 2025).

- Enter your bond number or scan the full list.

- Confirm your win and plan your claim.

Stick to official sites—fake sources can mislead you. For example, after the March 2025 draw, bond number 302855 won Rs. 80 million. Could yours be next?